how to reduce taxable income for high earners 2020

Your tax bracket depends on your taxable income and your filing status. Seniors must pay back all or a portion of their OAS line 11300 of the tax return line 113 prior to 2019 as well as any net federal supplements line 14600 line 146 prior to 2019 if their annual income exceeds a certain amount.

How To Easily Save 1000 In Taxes Every Year With A Blog Coco Chic Living Chic Living Inspirational Quotes About Strength Women Empowerment

There are seven tax brackets for most ordinary income for the 2021 tax year.

. 10 12 22 24 32 35 and 37. Seniors- Old Age Security Clawback Old Age Security OAS Clawback Income Tax Act s.

5 Outstanding Tax Strategies For High Income Earners

Tax Minimisation Strategies For High Income Earners

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Strategies For High Income Earners Lalea Black

5 Outstanding Tax Strategies For High Income Earners Debt Free Dr Dentaltown

4 Ways High Earners Can Reduce Taxable Income Truenorth Wealth

How Do Taxes Affect Income Inequality Tax Policy Center

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Interaction Of Household Income Consumption And Wealth Statistics On Main Results Statistics Explained

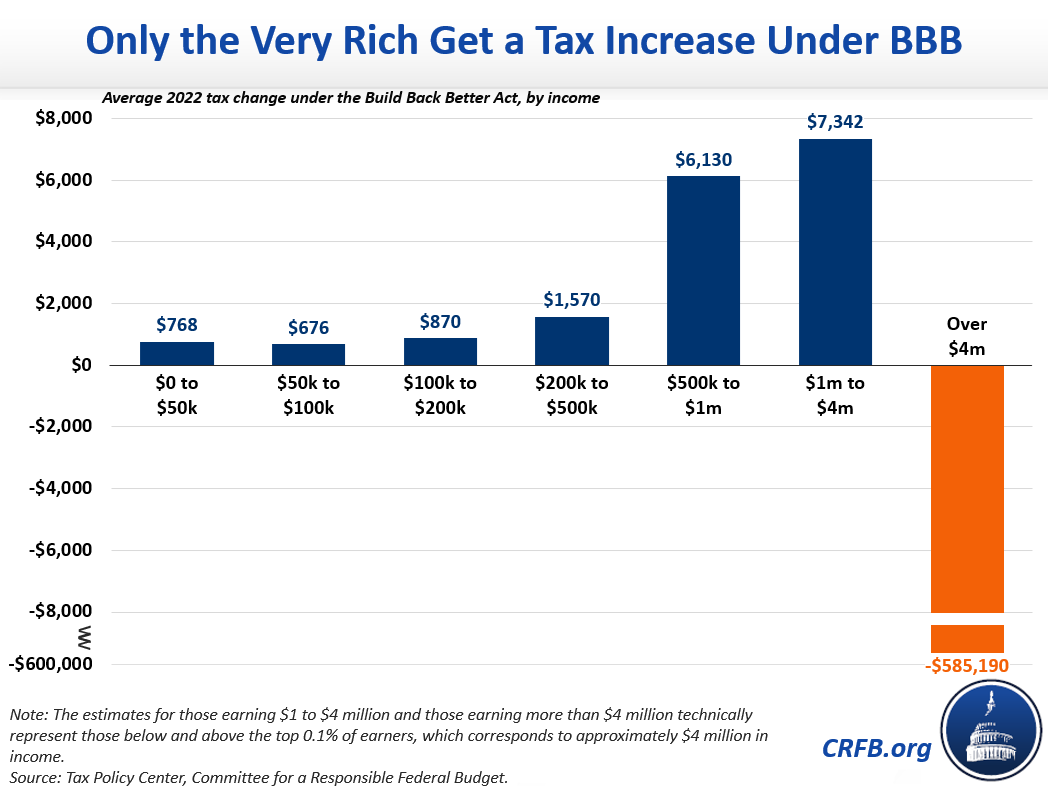

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

The 4 Tax Strategies For High Income Earners You Should Bookmark

2021 Medicare Costs Premiums Deductibles Irmaa Medicare Medicare Advantage Social Security Benefits

Five Different Ways Of Raising Taxes On The Wealthiest Americans

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Five Different Ways Of Raising Taxes On The Wealthiest Americans

6 Strategies To Reduce Taxable Income For High Earners

Biden S Tax Plan Explained For High Income Earners Making Over 400 000